The MENA region’s entrepreneurial landscape just got a massive boost with Aliph Capital, the Gulf’s pioneering woman-founded private equity firm, officially closing its debut fund, Aliph Fund I, at a formidable $200 million! This landmark achievement, announced on the sidelines of the Qatar Economic Forum, marks a significant moment for diversity in finance and robust growth capital in the Middle East.

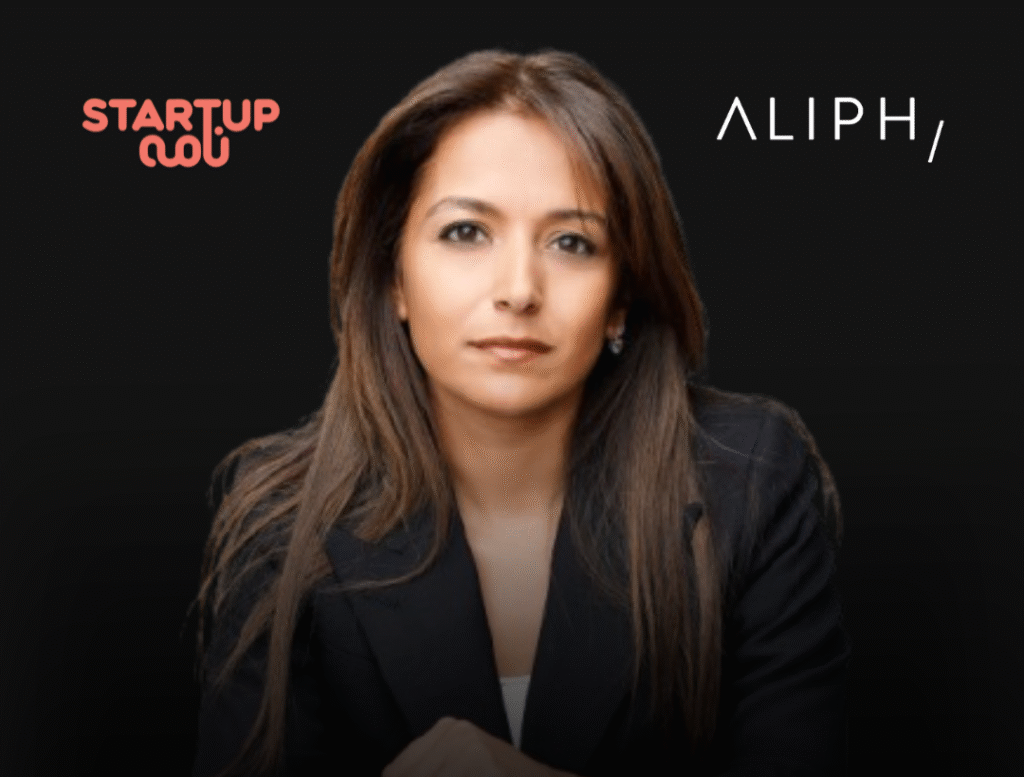

Founded and led by the highly respected Huda Al Lawati, a veteran with over 22 years of experience in private equity, operations, and investments across emerging markets, Aliph Capital is poised to reshape traditional businesses through active ownership and digital transformation. Al Lawati, whose impressive career includes leadership roles at Gateway Partners, Savola Group, and The Abraaj Group, is a true trailblazer in the investment world, having overseen over $2 billion in equity and $1 billion in debt deals. Her vision for Aliph Capital is clear: to empower promising GCC-based companies with the capital and strategic guidance needed to scale.

Despite navigating a challenging global private equity environment, Aliph Capital successfully secured commitments from some of the region’s most influential investors. These include Abu Dhabi sovereign wealth fund ADQ, the Saudi Public Investment Fund’s (PIF) Jada Fund of Funds, and Saudi Venture Capital (SVC). This strong backing from key regional players underscores the confidence in Aliph Capital’s strategy and the immense potential of the GCC market.

🎯 Investment Strategy: Digital Transformation for Regional Champions

Aliph Fund I is strategically positioned to inject between $15 million and $40 million into Gulf-based companies that are set to capitalize on the region’s booming sectors. This includes businesses in:

- Infrastructure products and services

- Healthcare

- Education

- Consumer industries

The core of Aliph Capital’s approach, as articulated by Huda Al Lawati, is to provide growth capital while driving digitalization to significantly boost scale and efficiency within its portfolio companies. This hands-on, value-creation strategy aims to transform traditional businesses into tech-enabled powerhouses.

💡 Early Success Stories: The Petshop & Sanipex Group

Aliph Capital has already demonstrated its strategic prowess with two key investments in UAE-based companies:

- The Petshop: Acquired in 2022, Aliph Capital has since championed a remarkable expansion. The Petshop’s physical footprint has more than doubled to 12 locations, new veterinary services have been launched, and a comprehensive digital overhaul has been implemented. This move taps into the rapidly growing pet ownership market in the Gulf, a testament to Al Lawati’s keen eye for emerging consumer trends – a personal journey that saw her, once avoiding pets, now owning three Shih Tzus!

- Sanipex Group: Aliph Capital acquired a 25% stake in this leading supplier of high-end bathroom, kitchen, lighting, and outdoor products. The firm is actively focused on succession planning and future acquisitions for Sanipex, strategically benefiting from the UAE’s booming real estate sector and the strong demand for luxury finishings. This investment highlights Aliph Capital’s ability to identify and support businesses poised for significant growth within flourishing industries.

This successful fund closure by Aliph Capital is more than just a financial milestone; it’s a powerful statement about the increasing maturity and diversity of the MENA investment landscape. It solidifies the region’s appeal for strategic private equity investments, particularly those focused on digital transformation and capitalizing on evolving consumer behaviors.

You may also like

-

MENA, Pakistan & GCC Tech Mid-Week Update

-

Canva Sets Up Regional HQ in Dubai, Pledges to Support 250,000 SMEs

-

Lebanon’s HAQQ Legal AI Raises $3M: Building the Operating System for a $1 Trillion Industry

-

Shorooq’s $200M QIA-Backed Fund: Solving MENA’s Missing Pre-IPO Engine

-

Qureos Secures $5 Million Seed Round to Transform Hiring with AI Across MENA and Beyond